Integrating AI into Your Decision-Making Workflow

In today's fast-paced trading environment, incorporating AI-based tools into your decision-making process can give you a significant edge. This guide will walk you through the steps to effectively integrate AI into your workflow, enhancing your trading strategies and outcomes.

1. Assess Your Current Workflow

Before integrating AI tools, it's crucial to understand your existing decision-making process. Identify key points where AI can add value, such as data analysis, pattern recognition, or risk assessment.

2. Choose the Right AI Tools

Select AI-based tools that align with your trading goals. Consider factors like:

- The types of assets you trade

- Your preferred trading timeframes

- The specific tasks you want to automate or enhance

3. Data Integration

Ensure your AI tools can access and process the data you use for trading decisions. This may involve:

- Setting up APIs to connect with data providers

- Cleaning and formatting historical data

- Establishing real-time data feeds

4. Start with a Pilot Program

Begin by implementing AI tools in a controlled environment:

- Use a demo account or paper trading platform

- Focus on a single asset class or strategy

- Monitor and compare AI-assisted decisions with your traditional methods

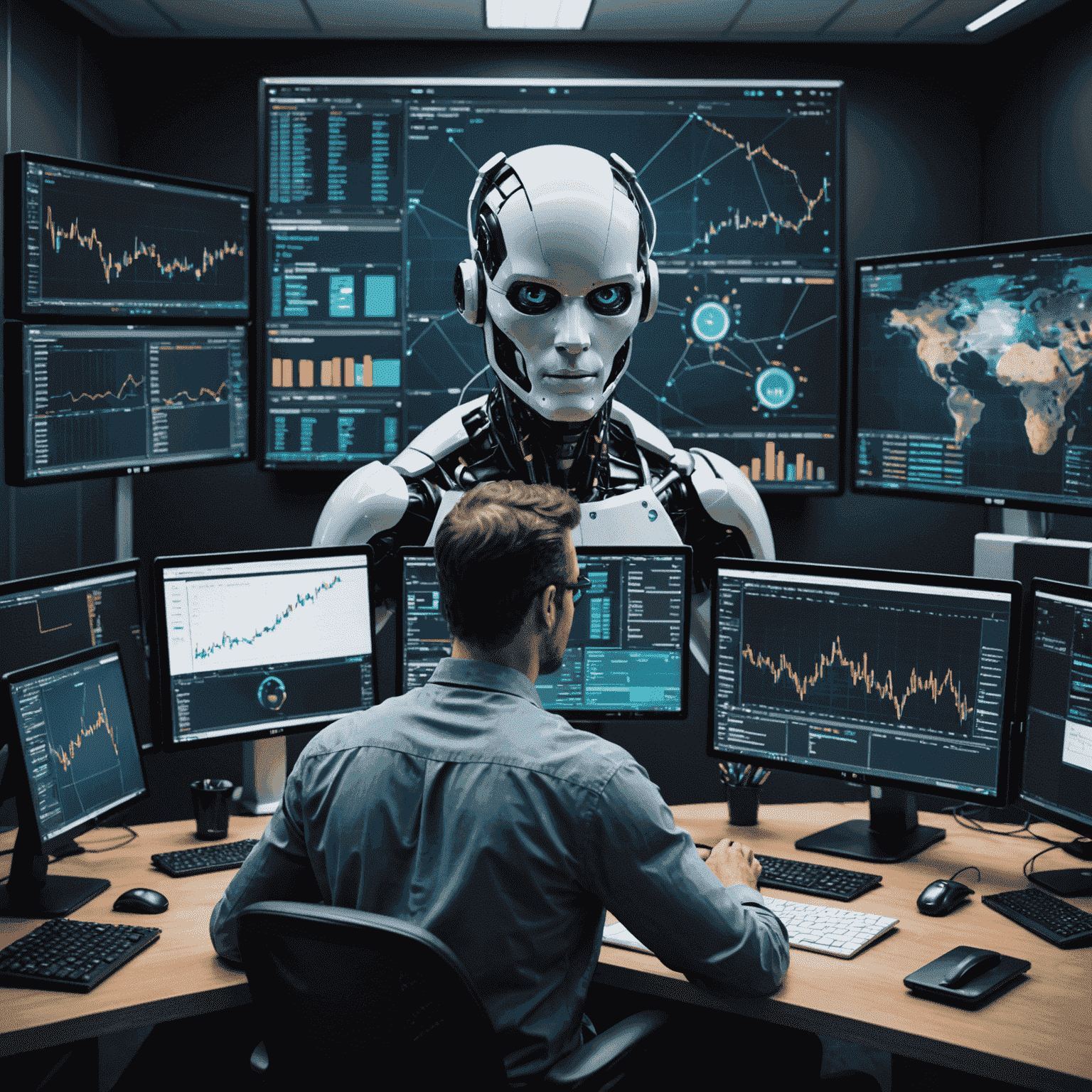

5. Develop a Hybrid Approach

Combine AI insights with your expertise:

- Use AI for initial screening and analysis

- Apply your judgment to interpret AI-generated recommendations

- Create decision rules that blend AI outputs with your trading principles

6. Continuous Learning and Adjustment

AI tools improve with more data and feedback:

- Regularly review the performance of AI-assisted decisions

- Provide feedback to improve AI models

- Stay updated on new AI features and capabilities

7. Scale Gradually

As you become more comfortable with AI integration:

- Expand to additional asset classes or strategies

- Increase the weight of AI recommendations in your decision-making

- Explore more advanced AI tools and techniques

8. Maintain Human Oversight

Remember that AI is a tool, not a replacement for human judgment:

- Set clear boundaries for AI autonomy

- Regularly audit AI decisions and outputs

- Be prepared to intervene when market conditions change rapidly

Conclusion

Integrating AI into your decision-making workflow can significantly enhance your trading capabilities. By following these steps and maintaining a balanced approach, you can leverage the power of AI while retaining the invaluable aspects of human insight and experience. Remember, the goal is to create a synergy between AI capabilities and your trading expertise, leading to more informed and potentially more profitable trading decisions.